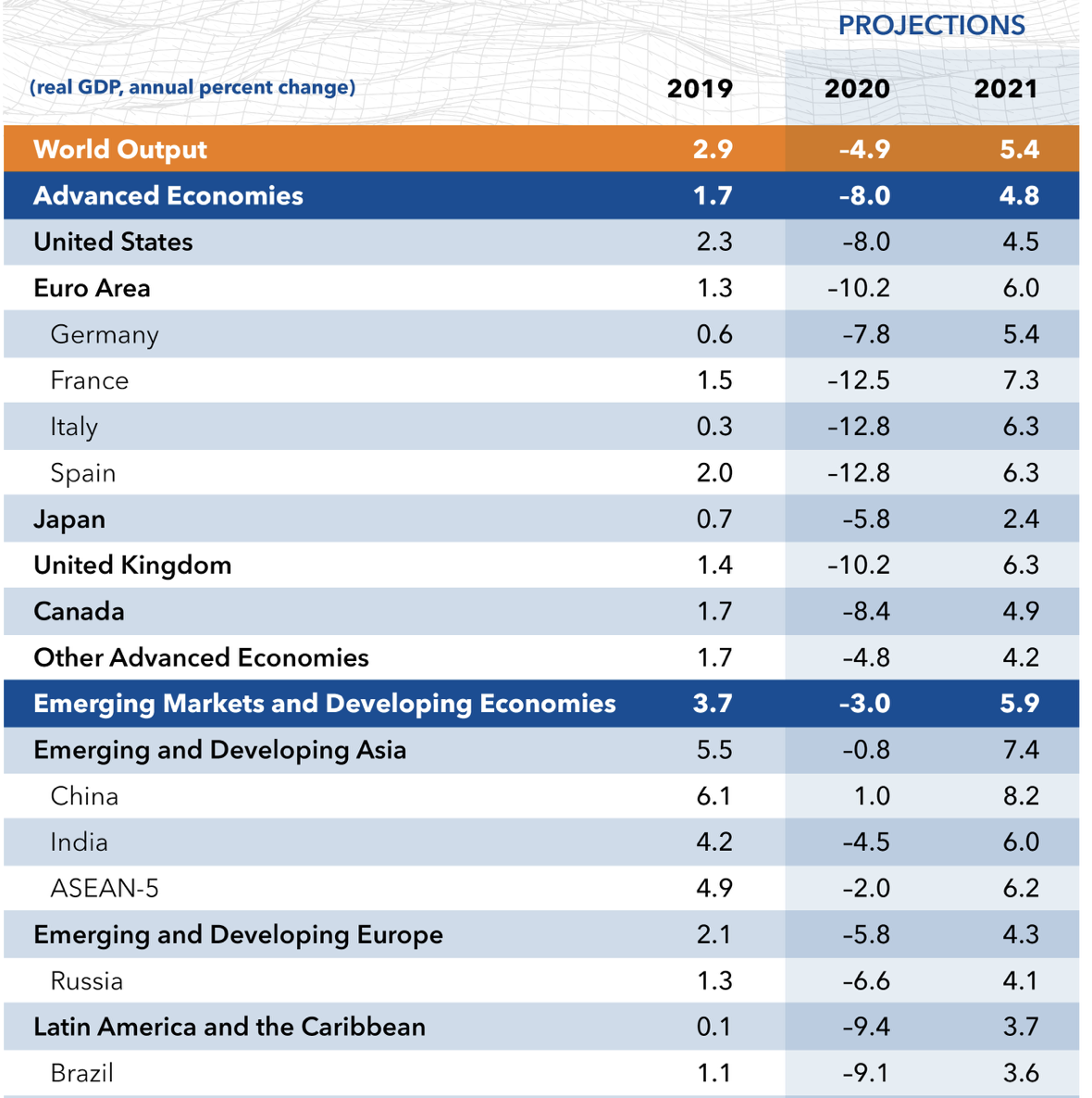

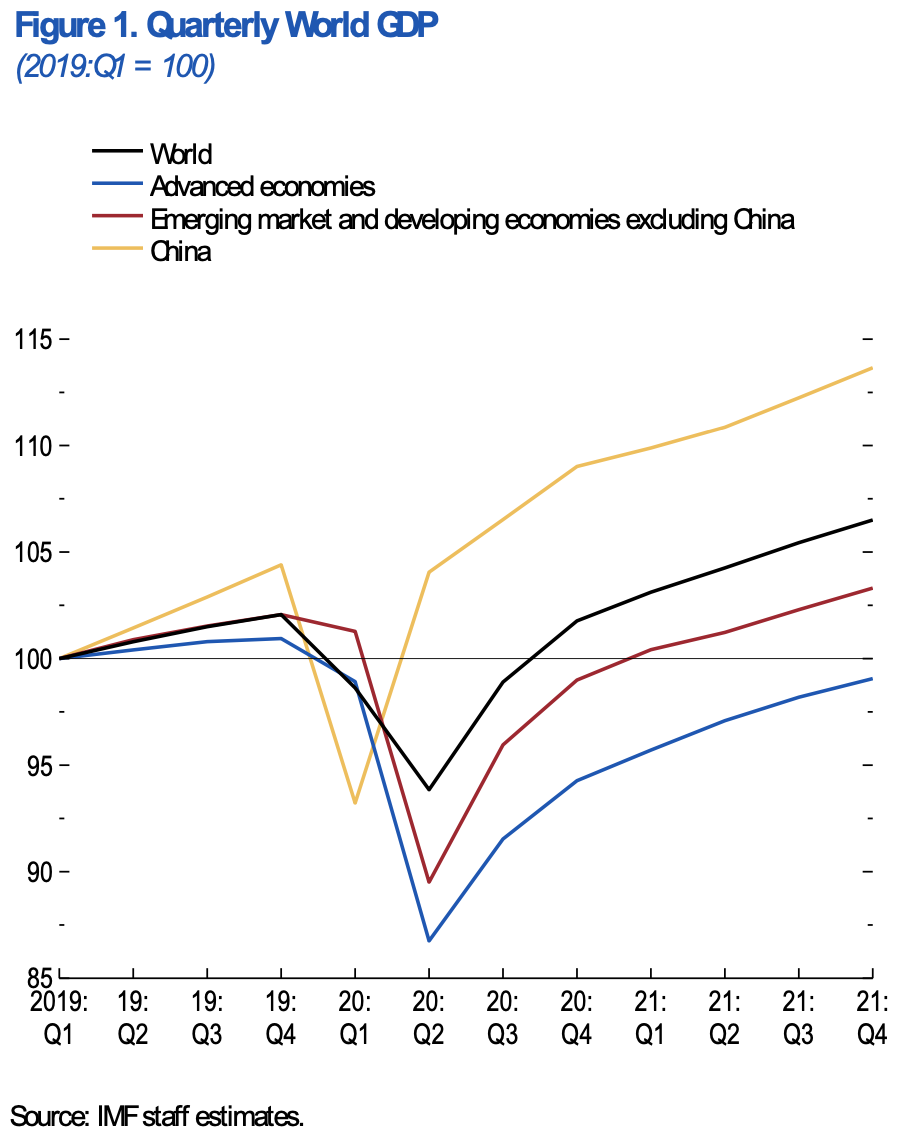

Bad news first. This is worse than 2008, “much worse” according to the International Monetary Fund (IMF), which called it “A Crisis Like No Other, An Uncertain Recovery” in the World Economic Outlook Update released in June 2020. This is not just a global recession like in 2008, but more like the Great Depression that happened in 1930, explains Ray Dalio, arguably the world’s most successful investor. His comments are echoed by the IMF’s projections for global growth, which shows that for the first time since the Great Depression advanced economies, emerging markets and developing economies are all in recession. The vast majority of countries’ economies will shrink in 2020 with a global projection of -4.9%, and advanced economies are projected at -8%. Income per capita is expected to shrink in over 170 countries.

Now for some good news. China is in many ways is already getting back on track after the economy shrinking by 6.8% in the first quarter compared to same period last year. While there is no doubt it will take a serious hit in 2020, from 6.1% last year to a projected 1.0% this year, that would make it only country on the list to still have positive growth in 2020. If IMF projections turn out to be accurate for 2021, China will have the strongest economy in the world in at 8.2%. In the shorter term (6-12 months), we are all likely to be challenged, in the longer term (1-3 years) things can be better than they ever have been, for some.

This article builds upon on the premise “what doesn’t break you makes you stronger” in my previous article entitled ‘Could the Coronavirus make China Stronger than Ever? 10 Trends that Indicate it Will’ which has been shared over 1000 times with over 100,000 views on LinkedIn, has been sent around the internet from Facebook to WhatsApp groups to multiple WeChat accounts reposting it, and has been translated it into Chinese and French, and led to an interview on CGTN. The basic idea of the article is that while China’s economy will undoubtedly be hit hard at the beginning of this year, with some industries hit harder than others, China has the strongest macro-economic mechanisms in the world for preventing a severe economic slowdown. Now China has already returned to business and has contained the virus. The outbreak is but a small blip on China’s long-term development radar, and one that could actually accelerate China on its path towards becoming a fully developed nation by 2050 — China 2.0.

Those individuals, companies and countries that hope to fare well over the next few years would be wise to leverage China’s comeback.

So why does that matter to us as individuals and businesses? This article shares ten potential ways we can navigate our way through the next year, leveraging China to come out stronger that ever before. None of the below are quick fixes, all will take investment of time, energy and probably money. Right now is a time to take a moment (and ideally longer) to think very seriously about the direction you have been going and if that is still the best direction for you during and post COVID.

The world has changed, the economy has changed, politics have changed, businesses have changed, so if we stay the same, many of the ways we have done things are likely to become irrelevant soon if they aren’t already, and that’s a good thing, because it will force us to change too. Now is the time to reinvent yourself and your business, to question everything, to go back to base principles, to identify and operate by your core values. The world will not be stable any time soon, but you can be.

What can we do as Individuals and Businesses?

I’ve been interviewing “China Hands” on their personal stories to learn how they have managed to play their hands right in the China market. I have chosen ten of those interviews for this article which are relevant to supporting you in this COVID context. You can click on the images below to find a link to the interview on Youtube, or for those in China on Bilibili the Chinese video platform, as well as a link to podcast if you prefer audio. Welcome to Season 2 of the Your China Dream Video Interview Series – enjoy!

Strategy 1 – Build Bridges to China (by helping Chinese companies expand)

Not only has China come back online, but many of its tech giants have actually been fuelled by the Coronavirus as people have gotten more used to using online services during lockdown. Alibaba, whose B2C E-commerce Platform Taobao was essentially born out of the 2003 SARS epidemic, hasn’t done as well as tech companies that are more digitalized like Tencent (for gaming and WeChat) or Bytedance (Douyin & TikTok short video apps) during COVID, but regardless has found ways to survive. Sales grew 22% in the three months to 31 March, despite virus-related restrictions, and sales in the firm’s cloud computing division jumped 58%.

Certainly Alibaba has been hit hard by COVID in other business areas, particularly those dependent on the physical rather than digital economy, but now that business is back in China, on the longer term trajectory this matters little. In Alibaba’s quarterly earning press release, Daniel Zhang, Chairman and Chief Executive Officer of Alibaba Group, says, “Alibaba achieved the historic milestone of US$1 trillion in GMV across our digital economy this fiscal year. Our overall business continued to experience strong growth, with a total annual active consumer base of 960 million globally, despite concluding the fiscal year with a quarter impacted by the economic effects of the COVID-19 pandemic.” The company also predicted that sales for its next fiscal year could increase more than 25% from 2020.

Alibaba is aggressively pushing to expand right now, with their strategic goals for the next five years, consistent with their mission “to make it easy to do business anywhere”:

- Continue to expand our globalization efforts

- Serve more than 1 billion Chinese consumers

- Facilitate more than RMB10 trillion of consumption on our platforms

These five-year goals are guide posts that will help Alibaba achieve its vision for 2036 to:

- Serve 2 billion global consumers

- Enable 10 million businesses to be profitable

- Create 100 million jobs

The Alibaba e-commerce ecosystem in China is rivalled by no other, and as China builds out its Belt and Road Initiative connecting Europe and Asia as well as Africa together, Alibaba will likely be playing a significant role in the flow of goods. Those interested in leveraging the Chinese E-commerce boom as it goes global can get a head start by finding ways to integrate into the post-COVID Chinese E-commerce Ecosystem. For an example of a company that has created it’s own niche in the highly competitive Chinese E-commerce Market — meet Baopals.

Episode 1: Baopals Creating a Niche Among Chinese E-Commerce Giants

In this episode I visit Baopals to talk to the founders, Jay Thornhill, Tyler McNew and Charlie Erickson, who have taken on the task of creating a Taobao for foreigners. With over 50,000 expats registered, over 3 million products sold with a value of 170 million RMB and over 1 billion products available, they have done what nobody thought could be done, this episode is by far the funniest I’ve interviewed so far, enjoy! (Click here to watch/listen)

“We had no guanxi or connections, no permission, no relationship and no money so essentially we just had to build and we kind of gambled on the fact that what we were building would not only be a good platform but also that Alibaba, arguably the most powerful company in China, one of the most powerful companies in the world, would be ok with it, which eventually we found out that they are, and that was really cool, that was a big relief.” — Jay Thornhill, Baopals

Strategy 2 – Tap into the Chinese Market (from anywhere in the world)

While the trade war had been impacting China in 2019, according to McKinsey, “although traditional drivers of China’s economy—investment, exports, and manufacturing—are struggling, the country’s consumers remain confident….Consumers in China are proving to be remarkably resilient and remain a powerful, transformative force not just in China but also across the globe.” McKinsey is predicting that China’s future growth, which will remain strong, and instead of growth driven by investment will rather be driven by consumption. China’s urbanization is driving the expansion of China’s economy, with 850 million already living in cities in 2020, and 51% of which will have enough buying power to be considered ‘mainstream consumers.’ 14 of China’s cities are projected to be in the world’s top 25 cities in terms of absolute GDP growth over the next decade.

For those who have already entered the China market, refocusing efforts to make sure their Chinese audience is well served as China is getting back to business would be wise right now, and for those who haven’t entered yet this is the perfect time to get a foot in the door before the Chinese economy speeds past the rest of the world, with entry getting more expensive and the Chinese consumer getting even more sophisticated, creating ever more barriers to entry.

The good news here is that there are now more ways to access and interact with Chinese consumers than ever before. While it’s foolhardy to try and tap into the Chinese market without a team or partner on the ground in China, those can now be more easily developed through online means as Chinese people adjust to being more willing to conduct business online without face-to-face meetings due to necessities during the lockdown. The more digitized you can make whatever you do, the easier it will be, but that doesn’t mean it will easy. Competition is as fierce as ever and it will likely require taking your entire business model to the next level, but that also means that there are more people in China looking for opportunities to work for and with you. There’s a time limit on that talent being available, and if there’s one person you should listen to when it comes to building a team in China, without living on the ground, that’s Domenica.

Episode 2: Digital Keys to Unlock the China Market Without Living in China

In this episode I talk to Domenica DiLieto, founder and CEO of Emerging Communications UK. She has managed to set up a hugely successful Chinese Digital Marketing Agency without living on the ground here or in fact ever having lived in China, something that some people would say is impossible. Let’s find out how she did it! (Click here to watch/listen)

Advice from Domenica when it becomes possible to do so: “Get on a plane and come here, see it in practice, because you can’t possibly imagine how quickly things are moving.”

Strategy 3 – Leverage Chinese Platforms that are Growing (in a lean way)

It’s hard for anyone to keep track of all the platforms popping up in the Chinese ecosystem, and COVID has resulted in a whole new wave of innovation already. One tech unicorn which is the talk of the decade is Bytedance, which is now the highest valued startup in the world. ByteDance’s mobile apps raked in $157 million from January to March, 90% of which came from China. It was a record quarter for ByteDance, representing a 423% increase compared to the same period last year, and up 50% compared to the previous quarter, in many ways thanks to COVID.

ByteDance saw an uptick in usage of Douyin (China’s version of TikTok) during the lockdown period, going from users spending an average of 45 mins/day on the platform to 209 mins/day during lockdown. Surprisingly, 120 of these minutes were live-streaming, which wasn’t as popular before the lockdown. Outside China, TikTok was downloaded 315 million times from January through March, an amount that topped any other app ever for a single quarter. TikTok now has over 2 billion downloads overall, doubling its total from just 15 months ago.

Bytedance set a goal to almost double its global headcount to 100,000 by the end of 2020, the largest number of jobs in the area of gaming and many in e-commerce as Bytedance faces up to its rivals in those areas — Tencent and Alibaba. But it’s not just Chinese Tech companies that are up against Bytedance, Instagram and YouTube influencers are hopping on the Bytedance bandwagon in droves, realizing that it’s not just a fun app for pre-teens but an e-commerce and gaming integrated behemoth that can not only explode their fanbase overnight but also give them a platform to make serious cash. If you’re looking to jump on the bandwagon, look no further than Fabian Bern.

Episode 3: Bootstrap Your Business to Hack Your China Entry with TikTok & Douyin

In this episode I talk to Fabian Bern, founder of UPLAB. Fabian has been helping brands on Douyin and Tiktok way before they blew up and became the hot new thing. With a personal network of over 500 influencers he has hosted events in Singapore, Hong Kong, Shanghai, Berlin and New York. He’s a young guy who has only been in Asia for a few years, so if you’re looking for an example of someone who was able to hack the Chinese Digital Ecosystem, fast, and bootstrap a business with no money, Fabian is the person you want to listen to. (Click here to watch/listen)

“You shouldn’t take a big financial risk, and you don’t have to, definitely not in China. In China you can get rich when you have nothing, there are so many opportunities.” — Fabian Bern, UPLAB

Strategy 4 – Focus on What Works in China (because a lot of things don’t)

As China becomes more nationalistic, we’ve seen from recent mistakes of the NBA, Dior and Dolce & Gabbana that anyone who wants to do business in or with the country has to be more careful than ever of how they communicate and interact with the Chinese. While this was always advisable, it is now non-negotiable. The Chinese people are watching the mayhem ensue in the rest of the world right now and are proud of China’s ability to contain the virus and maintain internal stability. This feeds a justifiable nationalistic sentiment that shows the Chinese people their country is worthy of not just playing on, but in many ways leading on, the world stage.

From getting your website blocked, to getting annihilated by Chinese consumers on social media, you can’t get away with being an ignorant foreigner anymore, or even one who doesn’t put in effort to understand the Chinese culture and language. Learning to be humble in the face of the clear results that are being attained by the entire system in China is now a necessary prerequisite for being successful here. Humility, respect, acceptance, and understanding are all things you can control. Your ability to be on the ground or speak the language might not be, at least in the short term, but the excuses are getting thinner, and the Chinese less patient, expecting that people have done their homework if they want to play ball. The nuances are getting more and more nuanced, as I learn from the struggles of Josh Steimle who successfully expanded his business from the US to Hong Kong, but then met with harsh challenges expanding his business just across the border into Shenzhen.

Episode 4: The Challenges of Entrepreneurship in Shenzhen Compared to Hong Kong

In this episode I talk to Josh Steimle, an author who has written over 300 articles for dozens of publications including Time, Fortune, TechCrunch, and Mashable. He’s a master of influence, turning entrepreneurs and executives into thought leaders. We talk about how he has expanded his business MWI, which he has been running for over 20 years, from the US to Hong Kong and then to Shenzhen. We’re in a typical Chinese park for the interview, so do enjoy the karaoke singing in the background, cos well, why not bring a microphone and speaker to the park to sing by yourself? (Click here to watch/listen)

“You’ve got to come here and see it for yourself. Once you get here on the ground in China, you’re going to see things that you just wouldnt understand from watching documentaries on TV or on Youtube, from reading magazines, from reading books, once you’re on the ground, it’s an entirely different experience. You’ll see the scale, you’ll see how many people are here, you’ll see how fast stuff happens. It will just change your entire worldview.” — Josh Steimle, MWI

Strategy 5 – Re-evaluate your China Presence (and be resilient)

What got you here won’t get you there. Prepare yourself to change anything that needs to be changed. Pre-COVID China was already a rapidly evolving market that changed so fast it was hard to keep up. But now, even the most established businesses, supply chains and consumer behaviors have gone through a transformation during the COVID response. The new normal is anything but normal. For some businesses it is such a radical transformation they will not survive, at least in their current form.

90% of Fortune 1000 companies had secondary suppliers in Wuhan, but many had little or no interaction with them. But this new normal is not just about COVID. Now with the trade war continuing on top of COVID, what was once a given is now no longer. All businesses need now be more aware of the acute need to be adaptable at a moment’s notice. Zoom has gone from being available in China, to being banned in China, to being available again, to most recently only being available for people in China to join calls but not host them, unless they go through the official China sales team to buy a license to use Zoom as a registered business in China. Finding ways to be adaptable to meet the needs of the new market that is continuing to evolve is a filter through which many will not pass. What worked before is less and less likely to be enough to keep working. Those that are resilient enough to use this situation as an opportunity to update their China presence could potentially build a robust business model to catch the wave of growth over the next year.

In one example Master Kong, a leading instant noodle producer, reviewed dynamics on a daily basis when the lockdown hit and reprioritized efforts. It anticipated hoarding and stock-outs, and it tilted its focus away from offline, large retail channels to O2O (online-to-offline), e-commerce, and smaller stores. By continuously tracking retail outlets’ re-opening plans it was able to adapt its supply chain and recovered by more than 50% just a few weeks after the outbreak, and was able to supply 60% of the stores that reopened during this period — three times as many as some competitors. Now they have a head start as the market gets back to business. This journey of tweaking is never-ending, and takes an enormous amount of resilience, the one quality Alex Duncan says he sees in those who have been able to make it in the China market.

Episode 5: The Journey to Build the Best China Marketing Platform for WeChat, Weibo & Douyin

In this episode I talk to Alex Duncan founder and Evangelist for KAWO helping global brands to be loved on WeChat, Weibo and Douyin in China. He’s got solid down to earth advice on how to succeed in the Chinese market, keeping it real talking about the challenges and the importance of resilience. You may not like what you hear, but if you’re open to the truth this episode is not to be missed. (Click here to watch/listen)

“Not everything that glitters is gold, and that’s definitely true here in China. There are huge opportunities and there is a massive market, but also phenomenal challenges with tackling that market. You’ve got to make sure its at the right stage for what it is you are wanting to do.” — Alex Duncan, KAWO

Strategy 6 – Educate Yourself on China (as it keeps changing)

Staying up to date with the evolving trends in China is my full-time passion, and I feel I’m only scratching the surface. Knowing who to follow in the sea of voices of “China Experts” is not as easy as it would seem. While experience on the ground in China certainly matters, and the ability to understand Chinese means you can get info first hand, the specific niches in China are so wide that one can become a foremost expert on a specific vertical without having, or even needing to have, a great understanding of the wider Chinese context, whether that’s politics, culture or history. The question is, what kind of expertise is valuable in your particular situation?

For example the “old China Hands” (who have been in China for 30+ years) might speak Chinese well and even have experience building relationships with government, but that doesn’t mean they have any idea how modern Chinese tech ecosystem works (some certainly do). Likewise there are “young China tech-experts” who might have a very good understanding of how to create marketing funnels on China’s most innovative platforms might not have any idea how to sustainably integrate your business model into the Chinese market (some certainly do).

The reality is that there is no such thing as a “China Expert,” it’s not possible to be an expert on all of China, which is why I’m usually suspicious of people who use the term to describe themselves. How ridiculous would it sound to call oneself an “America Expert,” or worse, a “Europe Expert?” Now multiply that population a few times and you have the population of China. The problem is, when it comes to China, a vast, complex, rapidly evolving market, it’s not always clear what specific type of expertise you need. So navigating the treacherous valley of China Experts who all promise they can deliver (first red flag, nobody can guarantee your success in China) can be confusing to say the least. Enter one of the few China watchers I would actually recommend when it comes to understanding the Chinese consumer and tech scene, Michael Norris, who has done on the ground in-person interviews for years, and he stays on the leading edge of Chinese consumer and tech research.

Episode 6: Decoding Chinese Consumer & Tech Insights with Precision

In this episode I talk to Michael Norris, China Consumer and Tech Trend Researcher. He’s a loud yet accurate voice when it comes to analyzing the market, and his Chinese is on point, at the level of a Chinese college graduate, which really lets him get inside the mind of the Chinese consumer. He speaks fast, in both English and Chinese, so you may want to slow down the recording to catch all the nuggets of wisdom that he drops. (Click here to watch/listen)

Michael Norris on the precise meaning of ‘Guanxi’ (关系): “Value exchange, that’s the part that doesn’t quite register with as many people. The value exchange is not a one-off transactional value exchange, it is a continuous process, and that continuous process might last for the period of cooperation, it might last beyond that, it might last your whole entire life.”

Strategy 7 – Invest in Building an Audience (there are no excuses)

There are very few industries where the Chinese consumer is not of significant importance, so even if before COVID your business was doing quite well without the Chinese consumer as a specific target audience, Chinese consumers are increasing in importance in almost every category. So even if you are not thinking about immediate entry into the Chinese market, because the Chinese internet ecosystem is walled off from the rest of the internet, in many cases it’s worthwhile to start building brand presence on Chinese Social Media to begin to build a relationship with a Chinese audience, get feedback on your product or service and begin to modify what you do to meet the needs of the future Chinese consumer.

Missing out on this segment now is lost future opportunity for you to grow and prosper. Knowing how to market and sell to the Chinese not only pushes you to relook at your marketing and sales practices, in many ways the Chinese consumer is such a sophisticated consumer, that if you are open to learning and taking feedback from them, they can help you be more competitive in any market. One simple example here is to start putting content in Chinese out on Chinese social media to see how what you do translates into this context. Often direct translations are way off the mark and it’s a useful exercise to broaden your perspective to get an understanding of what attracts Chinese consumers. Investing in China is for the long term, gone are the days of making a quick buck or quick easy wins.

Lin Qingxuan, a cosmetics company, was forced to close 40% of its stores during the outbreak, including all of its locations in Wuhan. However, the company redeployed over 100 of its beauty advisors from the stores to be online KOLs (Key Opinion Leaders), leveraging digital tools, such as WeChat, to engage customers virtually and drive online sales, leading to sales in Wuhan achieving 200% growth compared to 2019. Chinese KOLs are a different breed and in many ways are way ahead of their counterparts in any other country in the world in their ability to leverage tech to transform views into sales. There are a lot of potential pitfalls here for brands not investing wisely to get a decent ROI though, so it’s best to do ample research before stepping into this space. From Micro-KOLs who are in the right niche, to utilizing the power of live-streaming, to experiential marketing there are so many avenues to go down it’s easy to get lost and waste a whole load of time and money, but that filter is also what will separate brands who have a solid Chinese audience in the future from those who don’t.

The tourist market globally has been one of the hardest hit, and as Chinese, by far the largest Tourist Market in the world, will not be traveling much any time soon, it could take years to recover. For those who have businesses related to the Chinese consumers outside China, to maintain future potential finding creative ways to keep an audience engaged online so that when the borders reopen the seed have been planted, you can be ten steps ahead of competitors.

Episode 7: How Hoteliers Tap Into the Unequalled Chinese Tourist Market

In this episode I talk to Anita Chan, CEO at Compass Edge, which helps hotels tap into the outbound Chinese tourist market. Having worked with Orbitz and Small Luxury Hotels of the World, she’s got her finger on the pulse of the Chinese Travel Industry. So if you’re interested in hearing about how to tap into the largest tourist market in the world, make sure you check out this episode. (Click here to watch/listen)

“Forget what you know about China and relearn about China.” — Anita Chan, Compass Edge

Strategy 8 – Tap into the Chinese Tech Ecosystem (because its the future)

No matter what anyone thinks of China as a whole, there is no denying that the tech ecosystem in China is years ahead, and speeding up, in almost every vertical with a few exceptions such as semiconductors and AI research (and of course a few more, but also less and less). The response to COVID has confirmed this tech supremacy on multiple fronts (see my previous article entitled Pandemic Alert: What Can the World Learn From China’s Coronavirus Containment? 8 Hi-Tech Strategies).

Tencent, as an example for the first quarter of 2020, grew its revenue by 26% year over year, reporting 32% year-over-year growth in ad revenue in the first quarter, much stronger than the 19% growth seen in the fourth quarter of 2019. Social-advertising revenue grew by a whopping 47%, mainly driven by Tencent’s WeChat Moments. Revenue from Tencent’s fintech and business-services division, including wealth management, cloud computing, and payment products, also increased by 22% year over year.

Kevin Kelly, who wrote the book about the Inevitable Tech Trends of the next 30 years, famously said, “the business plans of the next 10,000 startups are easy to forecast: Take X and add AI” and I edit that slightly to say, “the business models of the next generation of startups are easy to forecast: Take X and add Chinese tech.”

Chinese tech is not just another option or a nice to have, similar to how Silicon Valley redefined the human activity over the last few decades, Chinese tech will redefine the globe in the next few. From Social Platforms (Tiktok, WeChat) to Fin-tech (Digital Yuan, Ant-financial) to E-commerce (Alibaba, JD) to Social E-commerce (Pinduoduo, Xiaohongshu) New Retail (Hema) to 5G (Huawei) to Smartphones (Xiaomi, Transsion) to Gaming (Tencent, Bytedance) to Drones (DJI) to Augmented Reality (Baidu, Live-streaming) to Robots (restaurant/hospital servers) to Construction (Belt & Road, Wuhan hospitals) to Electric vehicles (BYD, Geely) to Green Tech (solar panels, greening) to Smart Cities (Shenzhen, Xiongan) to AI implementation (read Kai-fu Lee), the list of technologies where China is outpacing the rest of the world is getting longer by the day. To not be interacting in this market is to be behind the curve in preparing for the future. As I learn from Joseph Leveque learning about the Chinese digital ecosystem is a window into the operating systems of the future.

Episode 8: Growing a Business on the WeChat Powered Chinese Digital Ecosystem

In this episode I talk to Joseph Leveque, founder of 31Ten, a digital agency in Shanghai which provides WeChat and Web Development solutions. He refuses to call himself a WeChat Expert, due to the speed at which the WeChat Ecosystem changes, and he’s got great insight into the incredibly fast-paced digital ecosystem in China, how it is evolving and how you can take advantage of it. (Click here to watch/listen)

“If you really have the willingness to learn this environment and to be part of the innovation sphere here in China, there are literally thousands of opportunities.” — Joseph Leveque, 31Ten

Strategy 9 – Pioneer a New Market (from the emerging opportunities)

One of the fascinating aspects of the Chinese market is that even though the consumer is incredibly sophisticated, there are entire markets that are still wide open. From healthcare to quality food to a wide variety of services that just don’t exist in China yet, the opportunities are vast, but that doesn’t mean they are easy. Many products and services that have been mature in developed countries for a few decades are still just entering China now, and while competition is a factor, as some of these can be reverse engineered at speed by Chinese competitors, often the more important factor is adapting that product or service to the Chinese consumer.

Too many brands assume that because their product or service is popular globally, it will be popular in China. Many brands fall flat on their face before they realize the Chinese consumer and market needs special attention. But despite the energy, effort and investment needed, now are still golden years in China, and if you don’t do it, someone else will. The longer you wait the harder it gets to compete in the Chinese market, but it’s also a case of needing to act fast if you do, or local competitors will overtake at speed. Not everyone wants to play that high-speed, high-stakes game, and that’s a choice. Talking to Kimberly Ashton, who consciously decided not to go the online retail route when e-commerce was taking off, and then subsequently decided to close her health food retail store, demonstrates the importance of following our values as business people and doing what we are most passionate about, even if it means the end of one business model and moving on to a new one.

Episode 9: Pioneering the Health & Wellness Industry in China from Scratch

In this episode I talk to Kimberly Ashton, a pioneer in the Wellness Industry in China, who has created a foundation by educating the market for countless businesses to build upon. She’s highly respected and has been a mentor to many of the successful entrepreneurs I know in the Wellness space as she has a deep understanding of opening up new products to the Chinese consumer. If you’re interested in an innovative approach to blending East and West, look no further! (Click here to watch/listen)

Kimberly Ashton on localizing in China: “The Shanghainese are very strong about being Shanghainese, so it doesn’t matter if you’re from Ireland or Australia or Suzhou, you’re a foreigner technically, so we as ‘international foreigners’ also need to respect that as it can impact team dynamics.”

Strategy 10 – Diversify your Investments (in terms of time, energy and money)

The market is more volatile than anyone alive today remembers. With entire industries essentially being wiped out during lockdown, it’s wise to make sure you don’t put all your eggs in one basket. Having investments in different regions, industries and forms helps mitigate political and economic instability. With that in mind, if you don’t want to lose money, China is the only market to see positive economic growth this year, and at 8.2% next year, China is a good bet to invest.

But beyond financial investments, its never been more important to be connected with those who are most important to you, to support them and allow them to support you, to invest in relationships that are meaningful to you, and to do work that actually makes a difference. As challenging as things may seem at the moment, this changing environment offers up an opportunity to take stock of where you have been spending your time and energy, and whether that is what actually matters to you. How can you use this crisis as an opportunity to re-invest in what matters most?

“Have a big dream, something you are willing to devote years of your life fighting for, and translate that into daily habits.”

Episode 10: The Smart Way to Invest your Money, Time & Energy in China

In this episode I talk to Jeffrey Towson, Professor at Peking University, Bestselling Author of the 1 Hour China Series, and LinkedIn Top Voice with over 3 million followers. He shares his story of how he went from Wall Street to working for a Saudi Prince to becoming the expert in investment in China. If you have big dreams, but want simple tips, tune in and listen closely! (Click here to watch/listen)

“Trying to get your brain around all of China, good luck, its a big place and its getting more complicated every year. A lot of people, a lot of companies, the days of understanding China are over.” — Jeff Towson, Peking University

Conclusion – Are we Watching or Making History Happen?

How long will the dollar remain the global reserve currency? Are its days numbered? As China rolls out the Digital Yuan, comes to the aid of countries around the world in these challenging times, and powers forward despite having been hit with COVID, how will the greater world respond? Which of the economic powers on planet earth right now seem more stable? Which have the potential to lift the developing world (85% of the world’s population) into developed world status? The China Dream is but one country’s dream, and while we can find ways to leverage it as transformative for planet earth, what about the rest of us?

The Asian century seems to be here, and that can be a good thing, for most. 60% of the world’s population lives in Asia. With recent pleas for equality in the US, in addition to racial equality, how about we do what we can to support global equality? 85% of the world’s population lives in developing countries. We have a lot of work to do. Can we trust in humanity? What else is there to trust in? No individual can solve the world’s problem alone. We are in for a Great Depression, that seems unavoidable, but there is light at the end of the tunnel. It’s a long tunnel, of which COVID, racial inequality and the Depression are but a part. What about climate change? What about a technological Cold War? What about automation? What about a technological singularity?

Can we leverage these challenges? Can we see this as an opportunity to make things better? Can we adopt more conscious business practices? Can we operate with more authenticity and integrity? Can we come together? Great tragedies can lead to great transformations. What can we do now as individuals, organizations, nations, as a species to come out of this stronger than ever?

What is our World Dream?

__________

If you liked the article remember to follow me on LinkedIn and if you liked the interviews remember to subscribe on Youtube or Bilibili.

P.S. A bit of self-critique: I would like to have a more even distribution of female interviewees for future seasons. I would also like to have more diversity in general. I started off interviewing only foreigners in China, but I have since also started interviewing Chinese entrepreneurs on their China Dreams too, which I am very much enjoying and learning from. If you have someone to recommend, please let me know in the comments or reach out to me personally.

___

Now is the perfect time to do coaching, because this crisis, if it hasn’t already, is going to challenge you in ways you have never been challenged. Personally, I’ve gone from having one coach and a therapist last year to currently having 4 coaches and 2 therapists to support me in different areas so I can operate at my potential in this challenging period. Coaching is a proven effective way to support a leader to develop to deal with the challenges that present themselves.

These days I focus on coaching entrepreneurs and their leadership teams, or executives who are looking to strike out on their own and become entrepreneurs. In rare cases when there is a strong value fit, I do consulting for organizations to support them deal with adapting to the complexity of the modern world by leveraging the China market, digitizing their offerings or finding new ways of operating. As one of my clients says about working with me, “he’ll not only bring out your best, he makes your best better.”

Reach out to me on LinkedIn to discuss or add me on WeChat: fionnwright